Which of the following would be included in the journal entry to record the purchase? The inventory costs 310,000 FCUs and payment is required immediately.

Which of the following would be included in the journal entry to record the purchase?Īpex acquired materials from Foghorn Corporation of Mexico.

At the date of the transaction, theĮxchange rate is 1 FCU = P. The inventory costs 10,000 FCUs and payment is required immediately. Wilshire acquired inventory from foreign corporation. The journal entry MM should make to record the collection of this receivable is:

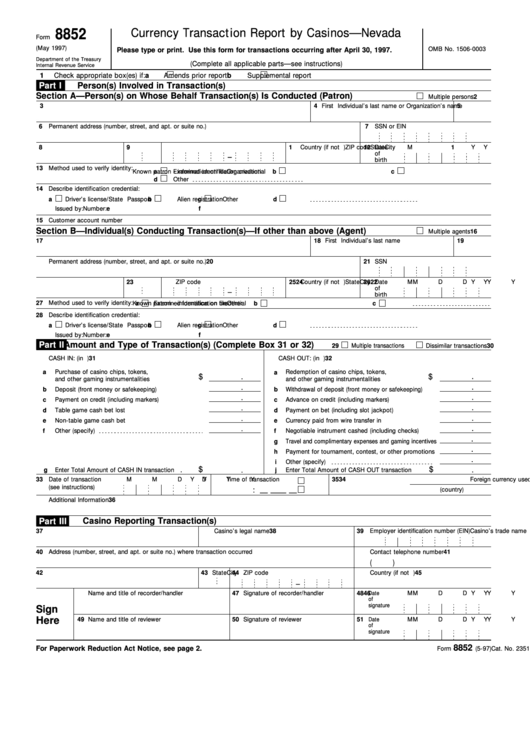

Currency transaction report amount full#

On January 15, 20x5, the receivable was collected in full when the exchange rate was 3 LPU to Translated into P315,000 on MM’s December 31,20x4 balance sheet. This receivable of 900,000 local currency units (LCU) has been MM Company’s receivable from a foreign customer is denominated in the customer’s local currency. In its income statement for 20x5, what amount should Denver include as foreign exchange gain or loss on the note principal? The Peso equivalent of the principal was as follows: On November 1 20x4, Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest bearing note due on November 1,Ģ0x5, which is denominated in the currency of the lender. Statements should report a foreign exchange gain or loss for the years ended December 31, 20x4 and 20x5: On January 10, 20x5 Auto paid 1,000,000 FCs acquired at a rate of P. On December 31, 20x4, the spot rate stood at P. If one Canadian dollar can be exchanged for 90 cents of Philippine peso, what fraction should be used to compute the indirect quotation of the exchange rateĭetroit based Auto Corporation, purchased ancillaries from a foreign firm on December 1, 20x4, for 1,000,000 foreign currencies (FC), when the spot rate for 1 FC

0 kommentar(er)

0 kommentar(er)